An Unbiased View of Hsmb Advisory Llc

An Unbiased View of Hsmb Advisory Llc

Blog Article

The Ultimate Guide To Hsmb Advisory Llc

Table of ContentsOur Hsmb Advisory Llc DiariesFacts About Hsmb Advisory Llc UncoveredHsmb Advisory Llc for BeginnersRumored Buzz on Hsmb Advisory LlcAll About Hsmb Advisory LlcThe Greatest Guide To Hsmb Advisory LlcThe Definitive Guide for Hsmb Advisory Llc

Also realize that some policies can be costly, and having certain health conditions when you use can increase the premiums you're asked to pay. Life Insurance St Petersburg, FL. You will certainly need to make certain that you can manage the premiums as you will certainly require to commit to making these settlements if you want your life cover to stay in placeIf you really feel life insurance policy can be beneficial for you, our partnership with LifeSearch enables you to obtain a quote from a variety of carriers in dual fast time. There are various kinds of life insurance policy that aim to satisfy various defense needs, including level term, lowering term and joint life cover.

The smart Trick of Hsmb Advisory Llc That Nobody is Discussing

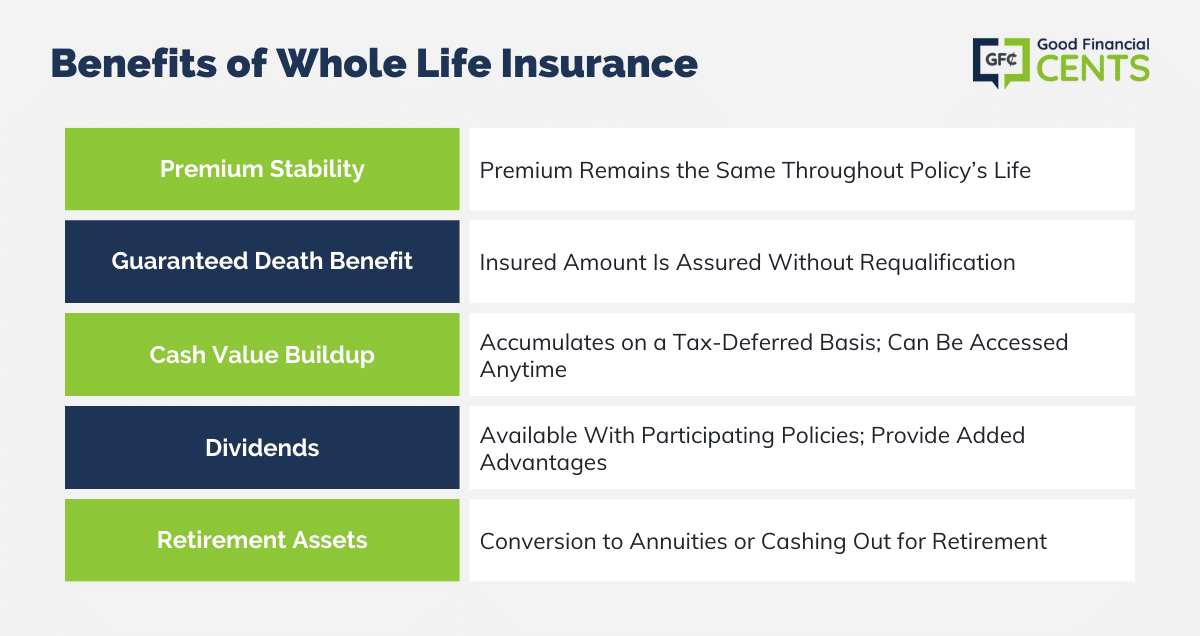

Life insurance policy gives five monetary benefits for you and your family members (Life Insurance St Petersburg, FL). The primary benefit of including life insurance policy to your economic plan is that if you die, your heirs obtain a swelling sum, tax-free payout from the policy. They can use this cash to pay your last expenditures and to change your revenue

Some plans pay out if you develop a chronic/terminal illness and some supply savings you can utilize to sustain your retirement. In this write-up, learn concerning the numerous advantages of life insurance policy and why it may be a great concept to purchase it. Life insurance policy offers advantages while you're still active and when you die.

The Ultimate Guide To Hsmb Advisory Llc

If you have a plan (or policies) of that size, individuals that depend on your earnings will still have money to cover their ongoing living expenditures. Recipients can use plan benefits to cover critical everyday expenses like rent or mortgage payments, energy expenses, and grocery stores. Typical yearly expenses for families in 2022 were $72,967, according to the Bureau of Labor Statistics.

All About Hsmb Advisory Llc

Development is not affected by market conditions, permitting the funds to build up at a secure rate with time. In addition, the cash money worth of whole life insurance policy grows tax-deferred. This implies there are no revenue taxes accumulated on the money worth (or its growth) up until it is taken out. As the money value develops gradually, you can utilize it to cover costs, such as getting a vehicle or making a down settlement on a home.

If you choose to obtain against your money value, the lending is not subject to revenue tax obligation as long as the policy is not given up. The insurance coverage business, nevertheless, will certainly charge rate of interest on the lending amount up until you pay it back (https://www.kickstarter.com/profile/hsmbadvisory/about). Insurance provider have differing passion rates on these car loans

3 Simple Techniques For Hsmb Advisory Llc

8 out of 10 Millennials overestimated the cost of life insurance in a 2022 study. In actuality, the typical expense is more detailed to $200 a year. If you assume buying life insurance coverage may be a clever economic relocation for you and your household, take into consideration seeking advice from a monetary advisor to adopt it right into your economic strategy.

The five primary sorts of life insurance are term life, entire life, global life, variable life, and last expense coverage, additionally referred to as funeral insurance. Each kind has various functions and advantages. Term is a lot more budget friendly however has an expiry date. Entire go to this site life begins costing a lot more, but can last your whole life if you maintain paying the premiums.

Hsmb Advisory Llc Fundamentals Explained

It can repay your debts and clinical expenses. Life insurance coverage can also cover your mortgage and give money for your household to keep paying their costs. If you have household relying on your earnings, you likely require life insurance policy to sustain them after you pass away. Stay-at-home moms and dads and company owner additionally frequently need life insurance.

For the most part, there are 2 sorts of life insurance intends - either term or irreversible strategies or some mix of the 2. Life insurers supply numerous types of term strategies and typical life plans as well as "interest sensitive" products which have become a lot more prevalent because the 1980's.

Term insurance policy gives protection for a specific period of time. This duration might be as brief as one year or supply coverage for a certain number of years such as 5, 10, 20 years or to a specified age such as 80 or in some instances approximately the earliest age in the life insurance policy mortality.

Everything about Hsmb Advisory Llc

Currently term insurance rates are really competitive and amongst the lowest traditionally knowledgeable. It must be kept in mind that it is an extensively held belief that term insurance is the least expensive pure life insurance coverage available. One requires to examine the policy terms thoroughly to choose which term life choices appropriate to fulfill your particular scenarios.

With each brand-new term the premium is boosted. The right to restore the policy without proof of insurability is a vital benefit to you. Or else, the risk you take is that your wellness might wear away and you may be incapable to get a policy at the exact same prices or also at all, leaving you and your beneficiaries without protection.

Report this page